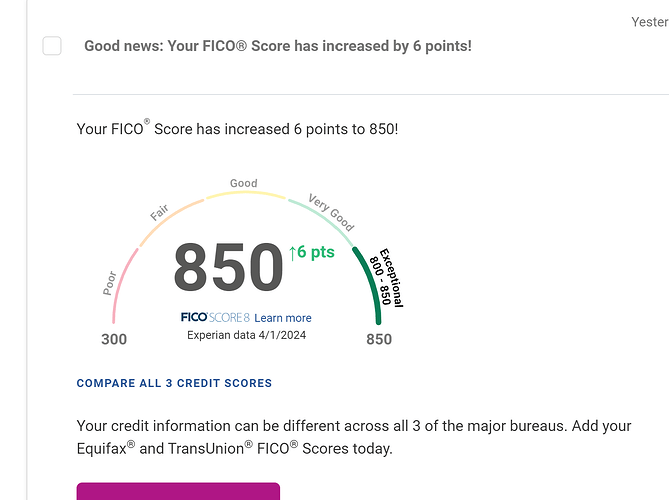

i can die in peace now.. i did not think it was ever possible to get to this magic number.. thought it was a myth.

Nice, once you get above 800 its pretty much just bragging rights. Probably even once you get above 750 it is the same to most lenders.

Here is mine from the same site.

Was a long road from doing a short sale on a condo around 10 years ago.

Congratulations! Not very often we can say we're perfect. And...we're twins!! ![]()

The best part is that I'm at 850 and my wife is like at 830 or 840 or something, and she is by far the more financially stable\responsible of the two of us. I've had some fun teasing her about it. Makes her crazy. ![]()

Now you just get pissed when your credit utilization for a month drops you a few points. Time to increase those limits!!

LOL < totally true ![]()

Lol... now try to get it on all three (experian, equifax, transunion).

Then you have your other algorithms used by car and home loan providers...

I had mine to 840 once.

You REALLY have to be aware at every decision, "How is this going to affect my score".

My problem.... I like to spend $$.

Normally.mine is lower 834-840 as i have high cc bills which they dont seem to notice i pay in full every month.

Meh, good enough. lol

@danabw: My wife is a couple points higher than me for some reason. She probably has a an account open somewhere that changes her debt:income ratio. Who knows.

Wait for the next time she's paying one of her credit card bills, pretend to take it out to the mailbox for pickup and then stash it somewhere, and wait for the fun to begin.

![]()

I would never do this to my wife because I value my life, but I'm open to hearing about your adventures. ![]()

Even better we have joint savings and.indiv linked checking accts. I could tx money out b4 chwcks clear. Id be dead. I normally transfer money in from broker acct which she has access to and could do herself but for some reason asks me.

I'm 47. My mother is 78 and my father is 85.

They ran a very successful business in the 80's (government regulated).

My father was the salesman, and my mother was the financial analysist.

Eventually, dad filed bankruptcy... twice.

Mom kept the two kids in school... dinner on the table... clothes on our backs... etc.

Today, mom still complains that dad has a higher credit score than her.

It drives her mad.. lol.

"I paid the bills for all these years... he filed bankruptcy twice... and he has better credit??"

That's a great story, I can just see her pounding the kitchen table... ![]()

Just make sure you don't remind her that as late as the '70s women needed their husband's signature to get a credit card. ![]()

Lmao.. oh good god, please don't get her started ![]()

I'm old enough to remember 650 or higher was really good credit

780 is the sweetspot I think... I'm around 820... Shrug, don't need any better.

I haven’t taken out a loan since my most recent mortgage about four years ago, and I have no specific plans for the foreseeable future that would require a credit check.

So I have no idea what my credit score is currently ![]() .

.

can get it here free .. anytime you want ![]()

There are plenty of sources for free credit reports, including the three major US credit bureaus themselves (since they’re required to offer that to all consumers once annually by federal law).

My point is, I don’t know my credit score right now because I don’t need to ![]() .

.

It's a pretty great feeling when you reach that point where you can just "write the check" for whatever it is you want to purchase.

But can still be a good thing to keep an eye, I think…. Would it be one of these things that would reveal an issue if someone has usurped your identity to get loans or make purchases…? I keep an eye on mine for that reason.